Rhb Islamic Personal Loan 2020

An islamic personal loan is where the bank buys an asset on behalf of the borrower and selling it at a profit.

Rhb islamic personal loan 2020. Rhb you are about to enter a third party website and rhb banking group s privacy policy will cease to apply. There is no penalty for early settlement provided that you inform rhb islamic bank with a 1 month notice before terminating your islamic financing facility. Rhb personal financing is an option that is convenient and flexible at the same time with reasonable interest rates for an affordable monthly installment repayment.

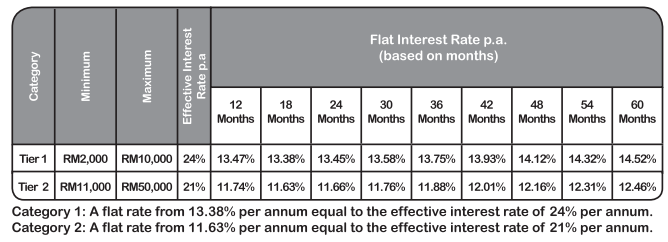

Category financing amount capping. Best islamic personal loans in malaysia 2020. Campaign period until 31 december 2020.

4 99 rm15 000 rm150 000 24 96 months alliance bank. 4 50 rm2 000 rm200 000 24 120 months al rajhi. Rhb bank berhad is the fourth largest fully integrated financial services group in malaysia.

2 only applicable for personal financing i. Established in 1997 from the merger of two banks to create malaysia s third largest financial services group. This link is provided for your convenience only and shall not be considered or construed as an endorsement or verification of such linked website or its contents by rhb banking group.

In fact you will be granted with ibra rebate based on the profits calculation and any applicable early settlement charges. Rhb bank berhad now has 210 branches in malaysia with 196 rhb conventional bank branches and 14 rhb islamic branches.